We all know that even well-planned construction projects can suffer delays to completion. To recognise this, construction insurance policies are tailored to allow automatic extensions of the programme until final completion of the project.

In recent years, insureds have enjoyed generous extension provisions which, irrespective of claims arising on the project, frequently provided:

- first three months of cover at no additional premium

- further extensions beyond the initial three months charged at no more than pro-rata of the original premium.

However, since the construction insurance market began to harden in 2018, the availability of the above extension terms has been increasingly restricted. Initially, the premium free period was reduced and subsequently removed to be replaced by all extensions being subject to pro-rata premium. Then, as the market deteriorated further, the extension period was challenged, with insurers insisting that any extension beyond three months be “at terms and conditions to be agreed”.

Why the changes?

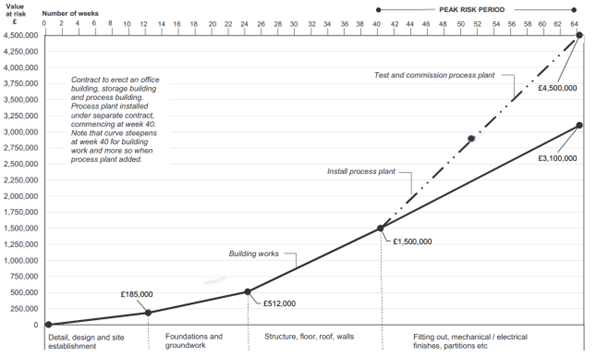

Insurers are seeking to charge more for contract period extensions because of the nature of their exposure on construction policies. At the point of inception there is less exposure for insurers as there are no works to be damaged; however, as the contract works progress, so too does the insurer’s exposure. A simplified example is provided below.

Source: The Insurance Institute of London, Report of Advanced Study Group 208B, Construction Insurance, Page 14, ISBN 0 900493 78 X

When extensions are arranged during later stages of the works, insurers argue that they are on risk with higher exposures for an increased period of time and that it is not an accurate representation of their exposure to extend the period at pro-rata of the original rate. Instead, the extension premium should reflect the additional time on risk with a higher value.

As brokers, we have resisted the use of “extensions at terms and conditions to be agreed” as it creates too much uncertainty for projects and instead are seeking, where possible, to limit increases to a percentage of the original premium.

How can you work with your broker to manage these potential increases?

There are several methods your broker can use to manage the potential premium increases for extensions. These include:

-

limiting insurers’ maximum increase at inception

-

making any rate increases contingent on a loss ratio being breached.

You can also assist your broker’s negotiations by confirming:

- the reason for the delay and whether the delay is due to loss or damage to the works

- the value of the works completed as at the date of the extension request

- whether any high value items have been installed.

It is also advisable to let your broker know as close to the start of works as possible if the completion timeline has moved as insurers are much more likely to look favourably at an extension request at the start of the project rather than near the end.

In conclusion

To enable the best outcome when negotiating an extension of time request:

- appoint a specialist insurance broker who understands the current market requirements and your risk

- approach the market as soon as possible and allow as much time for negotiations to take place

- provide as much information as possible to assist your broker’s discussions.

Here to help

If you would like more information or guidance on how best to present your risk to insurers, please do contact any of our specialists below.