Any successful SPAC, within two years, becomes a DeSPAC – the go-forward entity comprising the listing of the SPAC and the business of the enterprise acquired.

Just as SPAC’s face unique D&O insurance challenges, DeSPACs, which have been relatively common for about a year now, are unlike other listed-company risks. That said, insurers’ total appetite for DeSPAC risk is greater than it is for their more speculative SPAC predecessors, with more markets willing to consider providing the cover they need, since the risk is similar to that of an IPO.

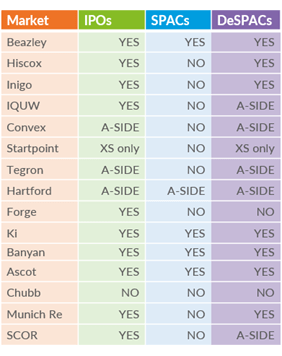

Lloyd’s syndicates, company market insurers, and MGAs in London and Bermuda are together able to offer roughly $50 million in D&O capacity for US based IPOs. The appetite for SPAC risk is much narrower, with a combined possible line of about $10 million. However, only a handful of the IPO insurers refuse to consider DeSPACs. That brings the total available line to about $25 million, but with one caveat.

There’s one wrinkle: no market is willing to cover both the SPAC and the DeSPAC, since it would leave them exposed to both sides of the transaction. That means SPAC customers are likely to need to change their panel of insurers, and a SPAC with cover of $50 million would have ample available market capacity of about $135 million, but not the full amount.

When a SPAC has completed its search (hopefully ending in acquiring a company to form a continuing, quoted business which fits at least roughly within the parameters of the SPAC’s offering document), it is necessary to purchase a coverage tower that provides appropriate limits of A, B, and C-side insurance. Activity in this area is heating up, as a bulge of SPAC conversions is beginning, with many more on the horizon. The market is buoyant, with plenty of deals to do, but they don’t go cheaply.

DeSPACs are underwritten and insured in the same way as a traditional IPO. The cost of coverage for newly listed companies is stabilising, but it remains expensive. A large number of potentially costly class actions related to SPAC’s are still pending, which has made insurers particularly and understandably cautious. So too has the huge increase in SPAC -related suits, which were about five times more common in 2021 than the previous year. We have yet to see a significant claims trend develop specifically for DeSPACs, but one is bound to emerge in time. Meanwhile, we expect enforcement action by regulators will increase this year, including the possibility of a Congressional probe of DeSPACs, with, frankly, completely unknown consequences.

A DeSPACked company can be made more attractive to insurers in the same way an IPO can be made less vulnerable to shareholder suits. Principally, their governance structures must be ready and prepared to become a public company. That requires, for example, a management team – and especially a chief financial officer – with public company experience. To gain underwriters’ favour, they require also a strong board of directors with relevant experience. The insurance proposal should draw out the relevant skills of management and board. If governance gaps remain, underwriters will want to see a concrete plan to fill them and will monitor progress.

DeSPACs are obviously fuelled by SPAC’s. While the pipeline is slowing in the US, we at Miller see an interesting trend of SPAC’s in new territories, including London (where a 2021 rule change saw the first SPAC, Hambro Perks, list in November), Singapore (which had its first two SPAC IPOs in January this year), and Hong Kong (with its new SPAC regime active from 1.1.22).

All told, however, the SPAC frenzy seems to have calmed. That’s not bad news, since the special purpose acquisition company remains a viable form of corporation-building, with great results when well managed. The pathway may now be embedded and attractive for experienced M&A specialists to take companies to market.