In the wake of Covid-19 and the ongoing Russia-Ukraine conflict, a topic in many market conversations is that of inflation.

Economic and social inflation have become major talking points for many in the insurance market in recent times. Whilst economists are predicting an inflationary spike in 2022, and a reduction in inflation thereafter, Lloyd’s are putting pressure on the market to consider the inflationary impact on their book and has implemented more rigorous measures in the 2023 business plan to show explicit and relevant inflation assumptions in addition to exposure and market related rate change, and any changes in the view of risk.

Firstly, it is important to set out the two types of inflation that underwriters are currently concerned about.

- Economic inflation – the increase in the price of something over time

- Social inflation –rising litigation costs and new areas of perceived coverage and the impact on insurers’ claim pay-outs.

Whether it be a result of recent global events causing resource shortage and driving a demand surge in prices, or more expensive, rigorous techniques being used, goods and services are increasing in price.

There are several ways inflation can impact (re)insurers, which could lead to a knock-on effect on insurance premiums:

- Rising cost of claims can erode underwriting profit

- Increase liability through reserve deterioration

- Increase reinsurer’s own reinsurance costs

- Value of investments may fall, reducing available capital

These concerns raise a number of key questions.

- By how much are prices increasing and are insurance claims increasing to the same extent?

- For how long will this level of inflationary pressure continue?

As may be expected, the answers to these questions are not simple. However, with quality claims data being recorded throughout the marine industry, inflationary trends can be more easily analysed and identified by categorising claims by loss type and size.

Analysis of each claim can be split out into ‘heads of damage’ that contribute to each event as it is likely that different components of a loss are impacted by inflation to differing extents. Losses, when broken down into broad risk categories, can be projected to ultimate and an annual increase in average cost per claim calculated to establish a trend over time to ascertain whether claims are in fact increasing in cost and therefore if there is an inflationary factor that should be applied. This method has limits as there may be other factors driving the increasing average severity beyond that of inflation.

Understanding changes to underlying exposure, coverage, and risk adjustment is essential to isolate the impact of inflation alone in the analysis. In completing this exercise, it has been observed that inflationary effects are generally more clearly seen at an attritional level, whilst larger claims are showing more volatile inflationary changes. It is difficult to identify a clear trend in ‘social’ inflation as increases in large losses are inconsistent and each claim is completely unique, with a multitude of factors contributing to the total loss cost (jurisdiction, loss location, loss type, legislation, social media, time of year loss occurs to name but a few).

While the insurance market sentiment suggests the average inflationary rate from 2022 onwards will be higher than the preceding years, preliminary analysis has found that the observed data has not yet shown this inflation in (re)insurance claim cost increases. Perhaps the reason for this is that retentions levels are increasing in line with inflation and thus cancelling out the expected increase at the attritional level. Or perhaps it is because the contract values of many risks have been pre-agreed in advance of the recent change in inflationary pressure. Another explanation may be that it is too soon to tell. Given this continued uncertainty, monitoring of losses will be important over the next 24 months as the market moves through further uncertainty.

The recent inflationary trends are, as the name suggests, recent. They should not be reflected in a review of historical annual inflation pre-2021. At Miller, we use our strong actuarial capabilities to argue that a tailored indexation approach i.e. taking a different view for each historical year, is more appropriate when inflating claims. Instead of applying a fixed annual inflation assumption when inflation-adjusting historical losses for analysis of the forthcoming (re)insurance year. This is important because the method chosen has significant impact on underwriters’ judgement of a client’s historical loss record.

Furthermore, open claims have an inflationary element built into the ultimate settlement, so a more nuanced analysis will look at the date an historical claim is closed.

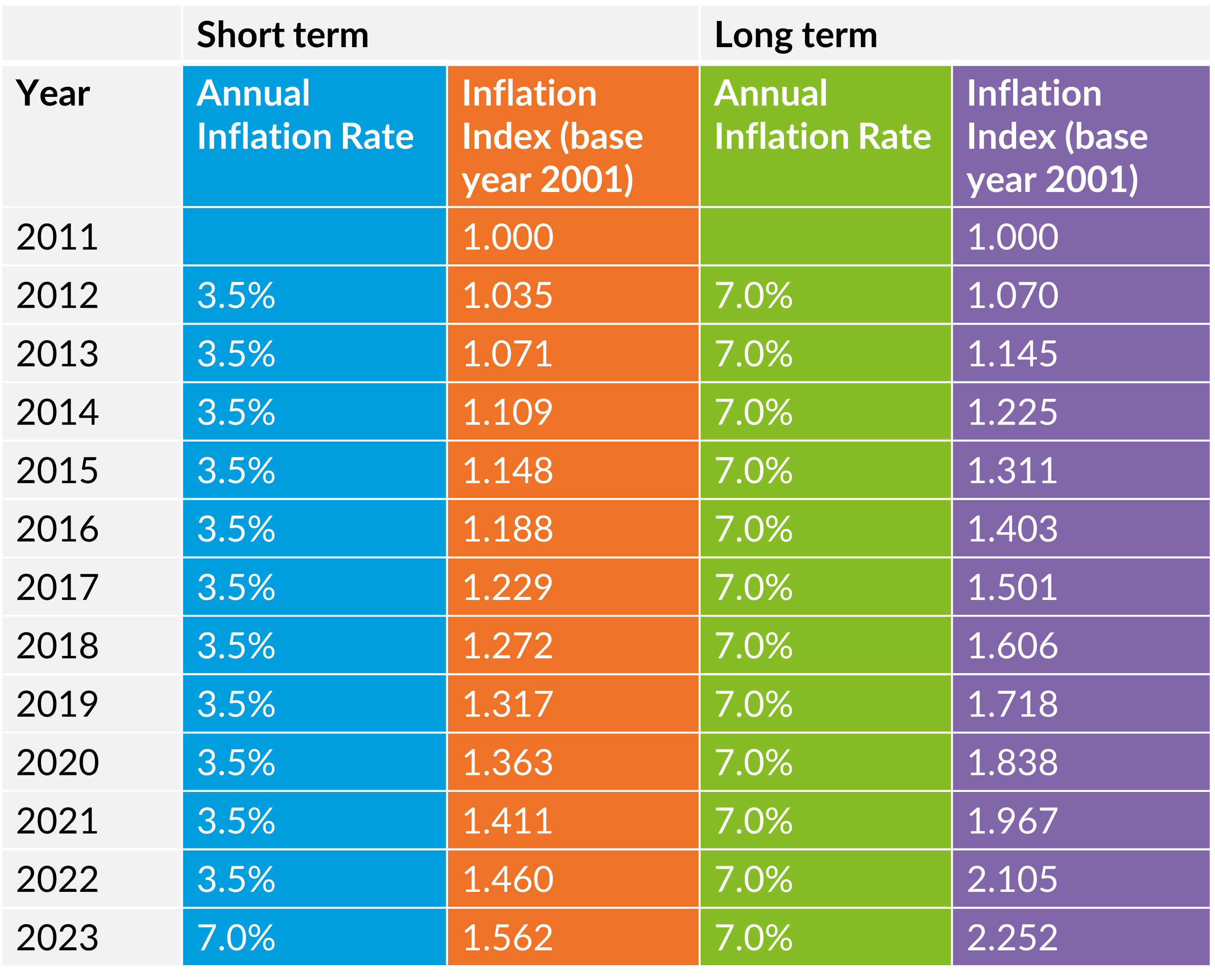

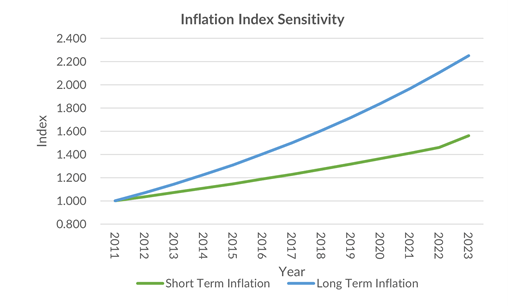

The graph and table below show the impact of applying a fixed annual inflation rate to historical losses, versus applying a more tailored inflationary index.

In conclusion, while inflation is a highly topical subject, general economic indicators of inflation (e.g., CPI or the retail price index) do not always directly feed into changing claims costs, it is very much business / product line dependant. Miller has worked with a number of clients in this area, to understand whether they have seen inflation in their portfolio yet and there is currently not enough evidence to show that insurance losses are increasing to the same extent as consumer goods and services costs are increasing.

Additionally, in relation to social inflation, factors driving up claims costs can be unrelated to the general economic environment. The main drivers of social inflation recently, have been the legislative and litigation developments that impact insurers’ legal liabilities and claims costs, particularly in U.S. casualty / personal injury insurance.

These trends suggest that (re)insurers should focus analysis on inflationary changes specific to the business written at the portfolio level, rather than take a broad-brush approach based on generic benchmarks.

Many markets have taken a view on 2022 inflation and beyond. At Miller, we are monitoring the inflationary developments closely. We believe that observing the actual versus expected loss severity by loss type and size will be essential to refine modelling and reserving to reflect true observed inflationary trends most accurately beyond 2022.