Lloyd’s first half results were announced a few weeks ago and the message from John Neal to a gathered audience of market participants, including Miller representatives, was clear; the underwriting discipline and review of unprofitable business that took place last year has paid off.

2019 half year results showing underlying improvements

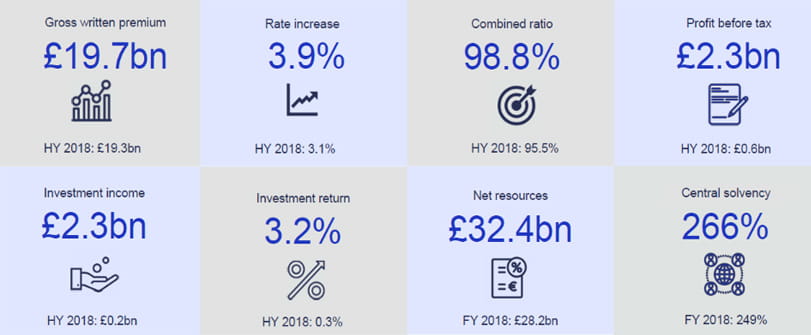

Source: Lloyd's market results, 30 June 2019

- Profit rose almost four-fold from £588mn a year earlier, underpinned by a combined ratio of 98.8%.

- Gross written premiums increased by 1.8 percent to £19.7bn compared to H1 in 2018.

- Investment income rose significantly to 2.3bn.

- The 2019 underwriting year shows a reduction in the attritional loss ratio when compared to the 2018 underwriting year.

- Quality of Lloyd’s balance sheet remains strong with overarching solvency coverage ratio increasing to 266%.

Other key points:

- Lloyd’s maintains strong reserves, better than other global counterparts.

- It satisfied S&P’s requirements to get a rate increase from A+ to AA. Standard & Poor’s took the decision to revise its outlook from negative to stable based on Lloyd’s level of capital exceeding ‘AA’ level.

- Lloyd’s is Brexit ready - 8% of business emanates from Europe and 65% of premium income is in dollars. Brexit may cause more competition for underwriters, and potentially open up new market opportunities later down the line.

Lloyd’s CEO John Neal explained...

“Lloyd’s has been working hard to ensure the market improves its underwriting performance by remediating the worst performing sectors in the marketplace. In parallel, we are also empowering high-performing syndicates to innovate across their portfolio and market.

“These actions are ever more important in an insurance industry awash with capital and at a time when falling bond yields will continue to challenge the profit and loss account through the balance of 2019 and into 2020.

“Therefore, whilst we are pleased to be reporting a return to profitability during the first six months of 2019, we recognise the importance of continued focus on performance management to maintain this momentum throughout the balance of 2019 and in future years. We will maintain the highest standards to protect customers, the market’s reputation, the Central Fund and our credit rating. It means our market will be here to meet our customers’ needs for generations to come.”