The claims process can be an anxious time for insureds and your London broker is there to make it easier. Andrew Ford, Head of Claims at Miller, outlines our claims offering and highlights the benefits of working with Miller.

What we do

It goes without saying that our Claims team is a very significant part of our client offering. When our clients choose Miller, we tend to remain their broker for a long time – and carrying the reputation for fast, efficient claims handling is a key reason.

Our team is proactive on the insured’s behalf and we extract the maximum from their policy wording. We anticipate the questions insurers will ask - identifying and negating obstacles before they arise.

As an insured’s conduit to insurers, we lead negotiations and smooth the claims process, understanding the challenge quickly and providing comprehensive support.

Process and types of business

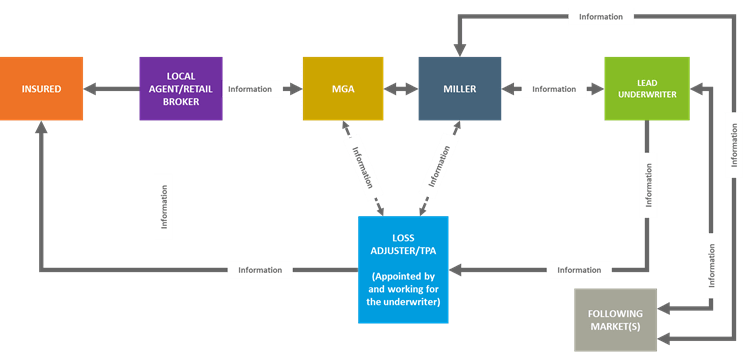

The claims that find their way to London from North America predominantly fall into two categories - high volume programmes (via MGA) or sophisticated commercial (re)insurance policies.

The former begins when direct insureds, such as US homeowners or commercial property owners, contact their local insurance agent or their MGA Carrier to notify their claim. At Miller, we work with the MGA to process these claims with the underwriters in London, often via our unique software program ‘Dash’, which speeds up the settlement process and allows the claim to be funded, providing the policyholder back in the US or Canada with a quick resolution. Issues requiring a greater degree of expertise are referred to Miller’s claims specialists, whose depth of knowledge assists in resolving the unusual and complex claims.

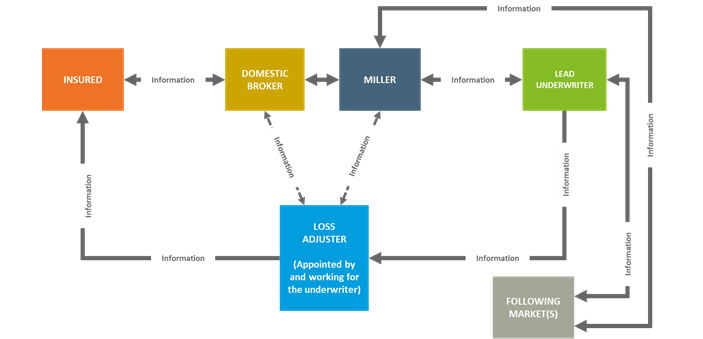

Sophisticated commercial insurance and reinsurance policies, often with high insured values sometimes require a significant degree of analysis and market negotiation. Political risks claims for international corporations would be a good example of where Miller has brought the full strength of our claims offering to bear, liaising with underwriters and ensuring consistently strong outcomes in favour of our clients.

The charts below explain how the various parties interact during the claims process in both of the above descriptions.

How we work

We manage the process all the way through from first notification to settlement. Involving the Claims team in client visits, renewal discussions, tenders or in conceptual coverage discussions has been key to many of our success stories. We are regularly on the road, visiting our North American brokers to help navigate any issues that arise.

Our in-house claims professionals liaise closely with our specialist placement teams which enables us to provide up to the minute, focused guidance. This also reinforces the seamless one Miller experience that our clients tell us they feel and appreciate when working with Miller.

We also have access to data showing the potential losses, so we are able to work with our analytics team to determine potential issues and improve programme structures.

On the MGA business, speed and turnaround is crucial. Our investment in technology and market leading programmes allow us to process 1000’s of claims efficiently in a short space of time, as well as track the progress of claims through our online systems. In fact, over the last decade we have handled up to 500,000 claims, many of which are US claims.

Visit the claims page now

Knowledge, experience and market influence

- Over the past 10 years, the claims we have handled have a combined value of USD34.8 billion!

- When problems occur, a good broker will be judged by their reaction and ability to solve the problem, for the client’s benefit. Our subject-matter specialists’ knowledge comes into its own when something doesn’t fit the mould. A recent example of this came when a production company was forced to cancel a number of events across the US following a fatality to one of its stars. The logistical challenge was enormous but with Miller’s guidance throughout the process, the insured were able to get the show back on the road. You can read more about that here.

- It is important that the placing teams are aware of which underwriters can provide our policyholders with well-considered, consistent and efficient claims service, and those who do not. Communication and discussion around this is vital for market selection and leadership roles and we think about this at the outset.

No policyholder wants to suffer a loss; our job is to ensure we all make the process as smooth, swift and easy as possible, providing the client with a satisfactory outcome that ensures they are pleased that they purchased their insurance coverage through Miller.

Real life case studies

You can check out some case studies of how we’ve got the job done in various sectors recently here.

Find out more

View more on our Claims capabilities here, or contact Andrew directly.