As we enter a new year, Miller's UK Professions team reflect on 2020 and outline what we expect to happen in the insurance market in 2021.

There is no doubt that 2020 has secured its place in the history books for a number of reasons (we will save Covid-19 for later), such as the current hard professional indemnity insurance (PII) market conditions that we have not seen since 2001, following the 9/11 terror attacks.

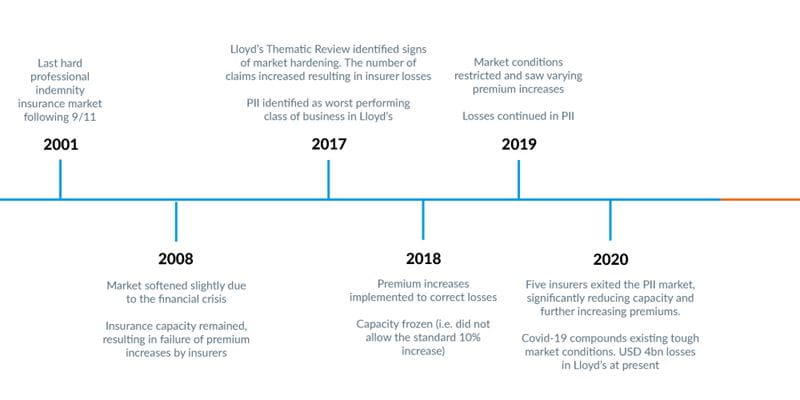

Every corner of the UK professional sector has been impacted with insurance capacity reducing and premiums increasing significantly. We broke insurance for a diverse book of clients from top 100 law firms to high street surveyors who all ask 'what has happened to the PII market?' Before we outline what we expect to see in 2021, we have prepared a timeline to provide some background information as to why the current market conditions are so challenging.

The first signs of the current hard market appeared in 2017. Lloyd's of London undertook a thematic review, which identified that PII insurance (and all financial lines in general) was one of the worst performing classed of business in Lloyd's. Lloyd’s instructed all insurers to review 2018 business plans to correct their losses. As a result, capacity was frozen and in extreme cases, Lloyd's refused to sign off business plans in certain sectors of business.

In 2019 the hard market was evident with premium increases across the market. Vibe, Neon, Acapella, Pioneer, China Re all exited the PII market in early 2020, resulting in reduced capacity. On average, we have seen premium increases of 25%, but in some cases more, with insurers taking longer to consider each risk and release terms.

Covid-19 and the continuing uncertainty on business viability has triggered a sharp rise in claims for insurers. This has in turn compounded an already very tough market place, causing concern throughout the insurance industry. Multiple large claims (such as business interruption) has resulted in a loss of USD4bn in Lloyd's at present and there are fears of a second wave of losses. Firms who renewed their insurances in or around April 2020 witnessed the full extent of the hard market combined with the tough lockdown restrictions that were put in place by the Government to try to combat this virus at its early stages. However, these tough restrictions are likely to stay in place for much longer than we had first anticipated; and with this in mind, insurers will require comfort that your business is viable, has the appropriate risk management controls/systems in place, which illustrate that you are a good risk to write. So what does that mean, what will insurers be looking for? Insurers are asking more questions than ever before, focusing on business continuity, cyber as well as Covid-19 specific questionnaires relating to remote working and financial viability.

Five key tips for renewing in 2021

Read more2021: What we expect

The turn of the New Year is unlikely to see any drastic changes with market conditions likely to remain difficult through 2021. The fear of a second wave of claims alone will have insurers taking less risks, and as we saw in 2020, their appetite for 'new business' will again likely be low, meaning that firms must present themselves in the best possible light to obtain the most competitive renewal terms. Covid-19 is having a colossal impact on the PII market and we continue to monitor as the pandemic unfolds, the first few months of 2021 will be critical to the economy and the insurance market to determine what capacity is available and the premiums quoted.

We anticipate that PII premiums are likely to rise again in 2021 as current hard market conditions will stay unchanged for much of 2021. Firms who secured their insurances in the first quarter of 2020 'escaped' the added scrutiny and additional requests for information from insurers following the outbreak of Covid-19. Given the information that insurers are now requesting, we strongly recommend being proactive by beginning your renewal preparations early, at least three months before your renewal is due to allow sufficient time.

With the above in mind, here are some key areas that insurers will be focusing on and requesting information in respect of due to their concerns in these areas:

Professional indemnity insurance

- Remote working – insurers will look favourably on firms where this is managed effectively, with appropriate IT platforms, systems, controls, procedures, audits in place to mitigate the risk of staff errors and rogue staff deliberately making errors.

- Supervision – what arrangements are in place for remote supervision? How effective has this been? Have there been are training points identified, and has this been cascaded to relevant staff to mitigate the risk of claims.

- Furlough – insurers will examine how staff who remain working are being effectively supervised, and that they are not under immense pressure, where mistakes are likely to occur because of staff shortages due to illness or other issues. Insurers are also likely to request information on staff members who return from furlough and how they are or will be successfully reintegrated back into the firm and are up-to-date on systems, controls, policies, and procedures, with appropriate training provided if required.

- Economic downturn – the UK economy is in a recession. In financial downturns there is an increase in PII claims as people look to blame professionals. Effective supervision and record keeping with diligent attendance notes is critical. This should all form part of your risk management systems and controls.

Cyber

- Managing remote working – home networks are less secure and there is increasing exposure to cyber criminals who also exploit weakness in systems and personnel. We have witnessed a significant increase in social engineering losses and ransomware attacks. Insurers will focus on how you effectively mitigate your cyber risks and what controls you have in place along with training, and how often this is provided to staff.

Directors' & Officers' Liability (D&O)

- Health and safety rules – firms are responsible to ensure a safe environment for their employees where work environments are currently open as well as those returning to work (when permitted). Firms need to be prepared for this and set up to adhere to Covid-19 rules.

- Employee wellbeing – this includes stress, mental health, ensuring that all staff have access to appropriate support and management receive relevant training to be able to assist staff members where appropriate, LawCare and Mind offer such support. Firms have a duty of care for their employees.

- Economic downturn – insolvency causes D&O claims, shareholder actions and disgruntled employees.

These types of claims could be linked to a recession or for example on D&O, a company becoming insolvent or being put into administration may automatically trigger a notifiable D&O event. With the sheer number of global firms struggling right now, particularly in areas such as oil and gas, airlines, travel and hospitality, insolvency risks have dramatically increased. Additionally, with directors having a duty of care to provide a safe working environment to their employees, there are questions on whether additional claims may arise here, particularly if a local regulator becomes involved and takes action against directors for failing in their duties.

Covid-19 questionnaires

To alleviate insurers concerns on the above, Covid-19 questionnaires are being requested more frequently, with firms facing more invasive questions from insurers around financial viability, income projections, and additional information on business continuity and social engineering controls all forming part of questionnaire.

The requested information will be in addition to what your proposal form asks of you and your business, being prepared and having the information available to provide to insurers will ensure that you are presenting yourself in the best possible light to obtain the most favourable renewal terms in what is a difficult market at present.

Five key tips for renewing in 2021:

- Utilise your insurance broker. Now more than ever you should be relying on their expertise to support you, especially in the following four points.

- Start preparing at least three months before your renewal date. Insurers are requesting completion of new Covid-19 questionnaires as well as more in-depth information on business plans and financial information. Do not leave it until the last minute.

- Risk management. Ensure insurers look on your firm favourably by including appropriate risk management systems, controls, processes and procedures. This will include supervision and addressing any claims. If you have had a claim, it is critical to demonstrate lessons learned as well as how you will ensure the same error will not happen again. Firms should also ensure that mental health awareness forms part of your risk management strategy, as this will give insurers comfort that your employees’ wellbeing is at the forefront of your business decision making, which in turn will reduce claims.

- Cyber. Additional information is required on social engineering controls. Consider cyber insurance and the effectiveness of having an emergency response team in the event of a cyber attack.

- Anticipate a premium increase so that you can budget effectively.

Contact us for help

Whether you have a simple question or would like to discuss your insurances in detail, our team of experts are here to help you. Speak to your usual contact if you are a Miller client or if you are new to Miller, contact one of our experts below who will be happy to help.

We wish you a prosperous and safe 2021!