PI market conditions have been favourable for over a decade with an abundance of capacity, falling rates and straightforward renewal processes. Since the Lloyd’s Performance Review in the second half of 2018, the London and International PI markets have implemented, and continue to enforce, a significant change in approach.

Background

As part of the Performance Review, Lloyd’s demanded that syndicates take action to address continuing losses on their non-US PI portfolios, identified across the market as the second worst performing class of business.

Novae, Channel, Brit, Aspen, Hamilton, Chaucer and Pioneer have all, over the past 18 months, exited the non-US PI market with other major players exiting individual segments such as Design & Construction PI. With no sign of new market entrants to replace these departures, there is a continued impact on availability and cost of capacity.

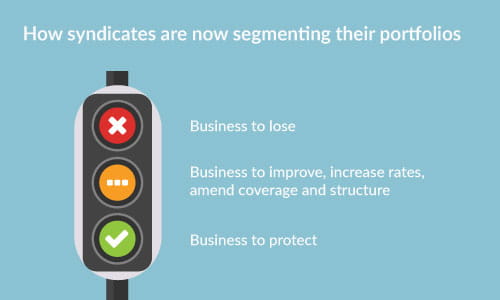

Syndicates who continue to underwrite non-US PI now have a strict mandate to re-engineer their portfolios with a focus on profit as opposed to growth. In order to achieve this, syndicates are segmenting their portfolios much like a traffic light system identifying business to protect – green; business to improve, increase rates, amend coverage and structure – amber; and business to lose – red, whereby the performance is so poor it cannot be returned to profit. The latter of the three allowing syndicates to make capacity available for more attractive business.

Impact on clients

Increasingly, PI renewals are taking longer, experiencing unexpected premium increases or restructures such as lower limits, higher deductibles and reduced coverage. Each renewal, no matter how “good” a risk, is subject to this new, in depth approach from the market.

We’re seeing price rises ranging from 10% to 50%, depending on risk profile, with challenging loss records or higher risk exposure accounts being hit the hardest and proving the most difficult. In addition, risks presented to underwriters at the last minute are being viewed in a poor light, so it is imperative that proposal forms are submitted well in advance of renewal dates to ensure the optimum time to negotiate the most favourable terms from the market.

How Miller can help

With the market in such a state of flux, policyholders should expect some turbulence when renewing their PI. It is no longer a buyer’s market nor a given that insurers will be in a position to offer the same coverage, limit or premium, as seen in previous years.

Now is when the benefits of using a broker to navigate this tough market will be felt the most. Finding the right wholesale partner can save you and your clients time, hassle and money. However, not every wholesale broker has access to all PI insurers or expertise across each PI segment, so it is imperative that you find one that works with a broad range of the market. With all the signs that capacity is likely to be in shorter supply, you might find fewer insurers being available or in a position to offer cover for your clients, therefore having more choice could be crucial.

Come and see us at stand B75!

About Miller's PI practice

Miller is a leading wholesale broker of professional, executive and financial risks. Our dedicated team of over 80 specialists arrange tailored coverage to suit the specific professional liability exposures of a broad range of insureds and industries. We provide independent advice, specialist expertise and beneficial long-standing relationships with Lloyd’s and London Company markets.

Whether it is securing capacity, developing innovative solutions for complex risks, or providing competitive rates on our broad and market-leading policy wordings, our partners know they can rely on Miller to deliver for them and their clients.