Organising an event requires meticulous planning and attention to detail. If an event cannot take place or is not completed as scheduled due to an uncontrollable or unforeseen circumstance, event organisers, sponsors and right-holders will all have a financial exposure.

Essential financial protection

Event cancellation insurance provides financial protection for the loss of expenses or revenues that result from the cancellation, abandonment, postponement, interruption, curtailment or relocation of an event (in whole or in part) due to uncontrollable or unforeseen circumstances.

Miller can arrange access to a suitable policy with limits that represent either:

- gross revenues (to include profit) or

- expenses (excluding profit).

Potential exposure

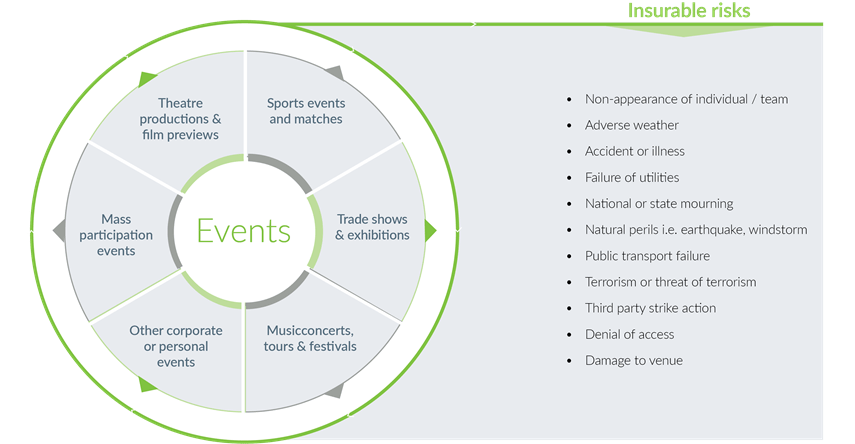

There are a number of risks that could cause events to be cancelled or interrupted, and it is often an unforeseeable event which leads to a claim. We outline some risk examples below, as well as the types of events that would benefit from cover.

Policy exclusions

There are some key exclusions to an event cancellation policy that insureds should be aware of.

Principal exclusions

- Financial failure, insolvency or default

- Withdrawal of support by any party

- Lack of sales

- Radioactive contamination

- Communicable diseases (including Covid-19)

Exclusions where buy-back cover may be available for an additional premium

- Adverse weather

- National mourning

- Civil commotion

- Terrorism

- War

Non-appearance insurance

Miller also specialises in placing non-appearance insurance for events that require key individuals to be present. Enquire for more details.